You may be wondering what is a balance sheet and how can my business benefit from them?A balance sheet refers to a specific financial statement that reports a business's assets, liabilities, and shareholder equity at a certain point in time. These sheets are used to help investors determine computing rates of return if they were to invest in the stock of a specific company by evaluating capital structure. In layman's terms, a balance sheet provides information on the assets that a company owns and the debts that they owe, helping investors to determine how much they could make on a specific investment. A balance sheet also informs a potential investor how much other shareholders have invested in the business.

What are the Key Factors of a Balance Sheet?

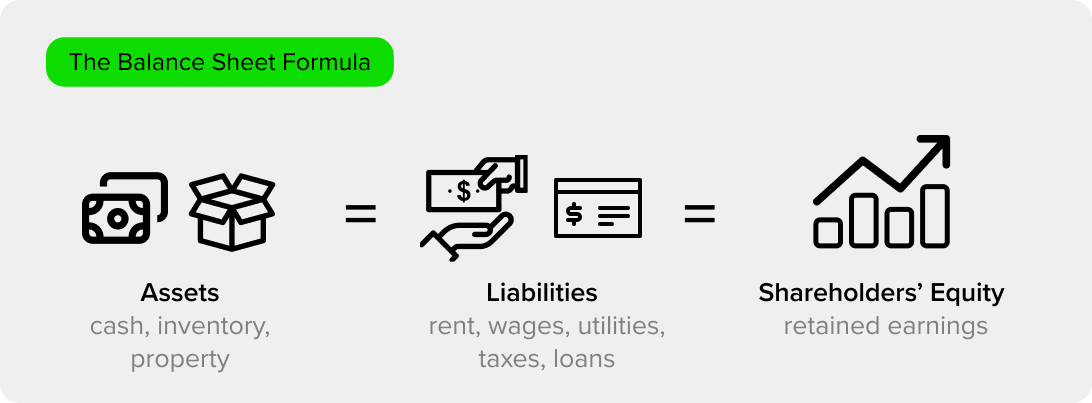

A balance sheet is made up of three core features; assets, liabilities and shareholder equity. Potential investors are able to analyze these three factors and determine the finances of a business at a certain point in time, looking at how much they own, how much they owe and how much stakeholders have invested.

A company may have numerous balance sheets set out over time, allowing for investors to compare growth and trends. Investors can examine specific relationships and ratios, providing important context about earnings and potential investment opportunities. This also allows investors to take the balance sheet of one company at a certain point in time and compare it against another, giving a good idea of where a business sits compared to its competitors.

How Do Balance Sheets Work?

A balance sheet gives investors insight into the financial position of a company at a certain point and allows for trends to be analyzed. There are a number of ratios that can be examined, like debt-to-equity ratios, providing information on the financials of a business at a certain point. Investors are also able to compare balance sheets to identify specific trends based on how the company has grown, helping to determine whether a business is getting stronger or weaker financially. While there are different components to analyze, a balance sheet format is typically presented in the same way.

The balance sheet equation used to calculate these different ratios is as follows; Assets= Liabilities + Shareholders’ Equity. This equation shows how a company purchases assets, whether it is through loans or through shareholders' equity, helping an investor better understand the financial dynamics of a business. At the end of the day, the equation should balance out, with the number of assets equal to the liabilities and shareholders' equity, hence the name ‘balance sheet’. It is important, as an investor, to understand how to read a balance sheet and analyze different elements and components of a business.

What are the Components of a Balance Sheet?

A balance sheet is made up of three main components; assets, liabilities and shareholder equity. These three components are placed in a formula that should be balanced, to give potential investors an idea of what the financials of a business entail. The following is a look at the basic functioning of these three different components and how they work together to provide vital information to investors.

Assets

An asset is anything that a business owns that has economic value. An asset does not have to be something that is tangible as it is anything that provides value to a business, for example, a patent to create something that is in high demand would be an asset, though it is not tangible. Assets should be equal to the liabilities and shareholders' equity on a balance sheet. The reason for this is that anything that a company purchases that is of value would need to be bought, creating liability or through shareholder equity. prepaid expenses on a balance sheet are an example of what would be included within this component as they are now considered to be assets.

Liabilities

A liability refers to amounts that are owed by a business, and generally, they are settled over a period of time. As with assets, liabilities do not necessarily need to be tangible, like a legal obligation for example. A business can have both short and long-term liabilities, all of which would have to be accounted for on a balance sheet. Accounting for liabilities is not just looking to see what a business owes in terms of debts, but it also accounts for growth. For example, if a company is going through a time of expansion, they would generally increase their liabilities as their assets also expand, making them vital when it comes to the development of a business.

Shareholder Equity

Shareholder equity, or net assets, refers to the money that is supplied by the owners of a business or the investors who have invested in it. This is an important part of any business, as this accounts for incoming funds that cannot be accounted for by assets. In order for a balance sheet to be truly balanced, this information needs to be present!

What are the Limitations of Balance Sheets?

- Assets may not be defined by their true value: Assets don't show the true amount of the current market value. The historical cost may show a depreciated value and will only remain true if the value of the asset has not changed since the time that the balance sheet was made. Balance sheets are one of the only financial statements that are relative only at a single point in time, and with markets constantly changing, this leaves room for inaccuracies.

- Some assets are based on estimates: Not all assets can be defined by a number, and therefore, some assets are based on estimates. While estimates can help to give an asset some sort of tangible value, they are often not exactly right, meaning that the information provided may not be accurate on the balance sheet itself.

- Not all components are based on numbers: While some assets can be either given a value in the form of a number or are even given a rough estimate, there are some assets that cannot be evaluated in this way. If for example, a business has a strong group of workers who are dedicated and experienced, you would not be able to account for this on a balance sheet. For some businesses, this would mean that some of their biggest and most valuable assets are not shown on a balance sheet.

What is the Importance of Balance Sheets?

While there are limitations to a balance sheet, they still provide vital information about a business's financial position to potential investors. As a balance sheet is designed to show what a company owns and owes, it can highlight specific financial information about value and growth investing, helping investors to make more informed decisions about whether or not your business has a value that they stand to gain. Balance sheets are designed to help investors determine potential risks with investing, assessing whether the debts outweigh the assets or whether there is enough money coming in to maintain and meet the demands of the liability costs.

Balance sheets can also help earn employee trust, as they can help to reassure employees of the stability of your business model. A business retaining employees is extremely important when it comes to creating a stable and functioning work environment. Balance sheets help a business to retain its employees by ensuring that they are aware of where the company stands at all times.

How to Prepare a Balance Sheet?

While many balance sheets are prepared automatically, it is important to know what goes into them to better understand how they are used. One of the first things to do is determine a reporting date for the balance sheet, helping investors to better understand the reporting period. Most companies create balance sheets that are based off of quarters of the year, meaning that a business would have four different balance sheets within one year. The next thing to do is determine your assets up to that point in the year, this would mean reporting on both current and noncurrent assets.

The next thing is to measure current and non-current liabilities, again this needs to be in line with the liabilities up to that point in the year. The next step is measuring shareholder equity, including all stocks and retained earnings over the period. The balance sheet accounts should be set up correctly to ensure that they are easy to read, with all different elements and amounts clearly tallied. A common size balance sheet shows the value of all entries and should also be included. The final thing to do would be to set up your equation to measure whether the items are balanced out.

Baraka is regulated by the DFSA

Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.