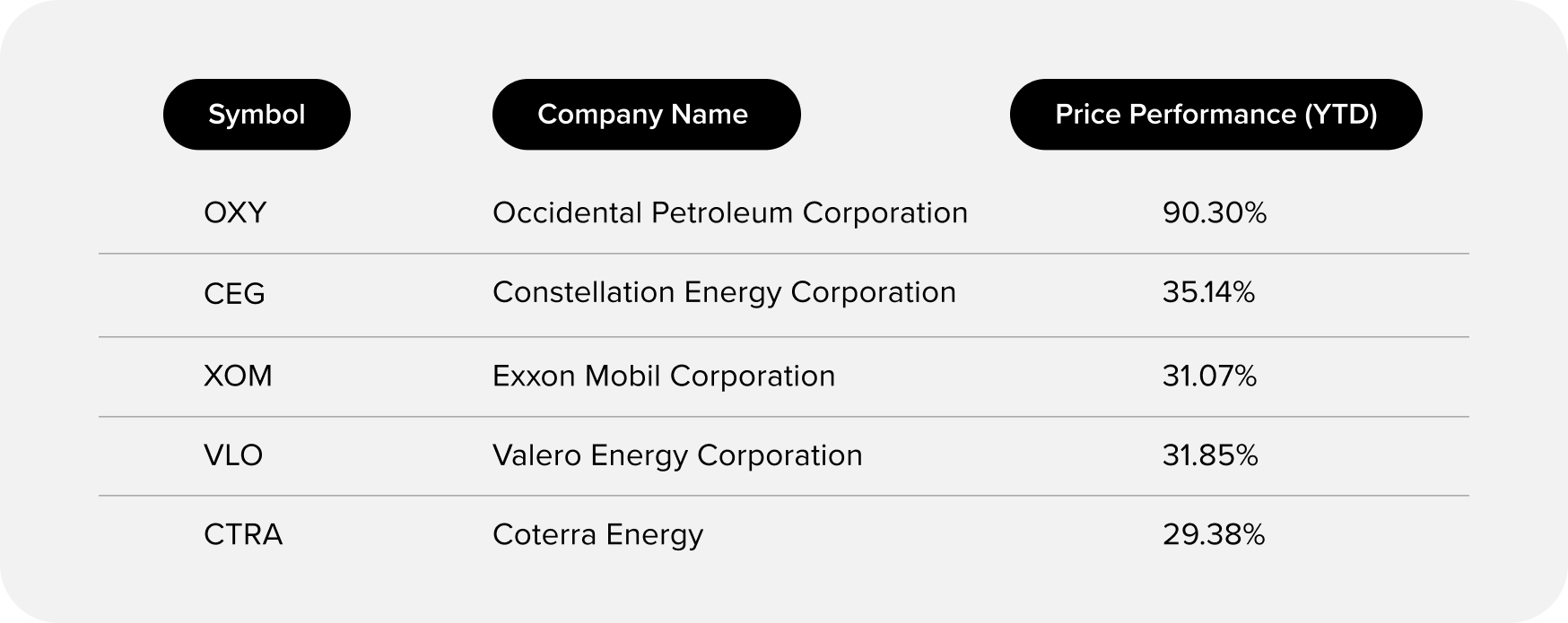

The following 5 stocks have had the best year-to-date performance in the S&P 500.

The S&P 500 has seen its worst first half of any year since 1970, with concerns around high inflation, aggressive interest rates, and geopolitical strife that has contributed to a 20% drop through June. Despite the recent turmoil, a handful of top-performing stocks have beaten the trend. But, as the market isn’t predictable, investors should keep close tabs on it and make their own judgement.

Here are the five top stocks from the S&P 500 so far in 2022, based on year-to-date performance.

Source: https://www.slickcharts.com/sp500/performance

Occidental Petroleum Corporation (OXY)

Stock Price on 20 July 2022: $62.82

Market Cap:

Occidental Petroleum (OXY), an US oil and gas company, rose to become one of the top 5 market performers of 2022, benefiting from surging oil prices along with backing from a major investor on Wall Street: Warren Buffet. In the last few months, Buffett's Berkshire Hathaway has deepened its pockets in the oil and gas company, increasing its stake to 16.4%, approximately 153,508,235 shares, and intends to purchase 84 million more shares, increasing his stake to 25%1 .

Constellation Energy Corporation (CEG)

Stock Price on 20 July 2022: $55.00

Market Cap:

Constellation Energy is one of the largest carbon-free energy generators in the US, relying on a mix of renewable resources such as hydro, wind, solar, and nuclear energy. This energy solution stock started its year by splitting up from industry giant Exelon (EXC)2. So far, the spinoff has helped CEG stock, which is up xxx% YTD. In addition, the company recently announced its plans to transition to clean energy and achieve net-zero emissions. Constellation Energy has plans to deliver 95% carbon-free electricity by 2030 to 2040 to its customers3. The company will rely more on its nuclear power units and new technologies to lower emissions and maintain grid reliability.

Exxon Mobil Corporation (XOM)

Stock Price on 20 July 2022: $88.27

Market Cap:

The Oil-energy giant, Exxon Mobil (XOM), will soon release its second-quarter earnings. In an update filed with the U.S. Securities and Exchange Commission, Exxon said operating profits would likely rise by $7.4 billion from the three months ending in March when it recorded earnings of $8.8 billion4. Exxon said the bulk of the gains —around $4.5 billion — would come from improved margins in the sale of gasoline and diesel5. The integrated energy giant expects its upstream business to generate a maximum of $3.3 billion in additional earnings in the second quarter6.

Valero Energy Corporation (VLO)

Stock Price on 20 July 2022: $108.74

Market Cap:

Valero Energy is a highly profitable American oil and gas refining company that manufactures and markets transportation fuels and other petrochemical products across the US, Canada, and the UK. The company is the second-largest producer of renewable fuels, giving it a wide range of growth opportunities. The oil refiner is known for its solid history of beating earnings estimates. The stock has beaten earnings estimates for the last two quarters, averaging 40.73%7. As mentioned, oil prices are rising, and rising inflation rates and strong demand contribute to higher margins; despite this, the company's EBITDA grew by 178% on a YOY basis8.

Coterra Energy (CTRA)

Stock Price on 20 July 2022: $28.14

Market Cap:

Coterra Energy, a relatively new natural gas producer, was formed last year after Cabot Oil & Gas and Cimarex Energy merged. The company is a large-cap company and has shown an accelerated growth rate among its large natural gas competitors. he company's net sales are expected to rise 85.3% to $6.93 billion this year and net income to soar 73.1% to $2 billion9. Along with its vigorous growth, it is forecasted to maintain high net margins compared to industry peers; the consensus expects CTRA's margins to reach 31.4% in 2022 and 29.4% in 20239.

Baraka is regulated by the DFSA

Past performance is no guarantee of future results. Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.

1 https://markets.businessinsider.com/news/stocks/warren-buffett-berkshire-hathaway-energy-stocks-occidental-petroleum-oil-gas-2022-7/

2 https://investorplace.com/2022/02/ceg-stock-alert-constellation-energy-pops-after-exelon-exc-stock-spinoff/

3 https://finance.yahoo.com/news/constellation-ceg-targets-net-zero-125512890.html

4 https://investorplace.com/2022/07/xom-stock-is-in-focus-as-exxon-predicts-record-profit/

5 https://www.thestreet.com/markets/-5-things-you-must-know-before-market-opens-tuesday-070522

6 https://finance.yahoo.com/news/exxonmobil-xom-projects-11b-upstream-140702381.html

7 https://www.yahoo.com/entertainment/why-valero-energy-vlo-could-161004088.html

8 https://investorplace.com/2022/05/the-7-most-undervalued-stocks-to-buy-for-june-2022/

9 https://investorplace.com/2022/03/3-natural-gas-stocks-to-buy-now-to-power-up-your-portfolio/