It's hard to deny that investor sentiment toward tech stocks has changed over the course of the year. As interest rates have gone up and recession fears have become more widespread, the market has turned from bullish on growth/tech stocks to bearish.

Apple's share price has been on the rise in recent months, with a tech stock rally and its prize-winning product—the iPhone—turning 151. However, the company's real test will be released in its fiscal 2022 third-quarter earnings report on July 28.

Currently, shares of the tech giants are down 17.84%, due to supply chain issues and general macroeconomic challenges. However, the company still seems to be gaining traction with its robust fundamentals as the largest company in the world by market cap2.

Demand

The global smartphone market is in decline this year3, with sales slumping as the market suffers from headwinds such as rising inflation and weak consumer confidence, along with ongoing COVID-19-induced lockdowns and geopolitical instability between Russia and Ukraine affecting sales.

According to Counterpoint, they predict a 3% decline in shipments4. The market share of Apple’s iPhone fell from 65% in 2020 to 50% in Q1 20225. Unlike previous years, Apple’s iPhone sales did not suffer from the current inflationary environment, which soared to 9.1% in June’s CPI6. The new decade high inflation, along with increasing costs as a result of supply chain issues, may impact consumers’ expenditure habits7. The company did issue warnings in its last quarter that revenue could be down as much as $8 billion due to a number of factors6, including the China Covid-related lockdowns, but strong expectations for the iPhone 13 and upcoming iPhone 14 suggest that impact may be somewhat mitigated.

Earning Estimates

Over the past three months, analysts have revised their estimates for Apple’s fiscal third-quarter earnings downward by 7.8%9.

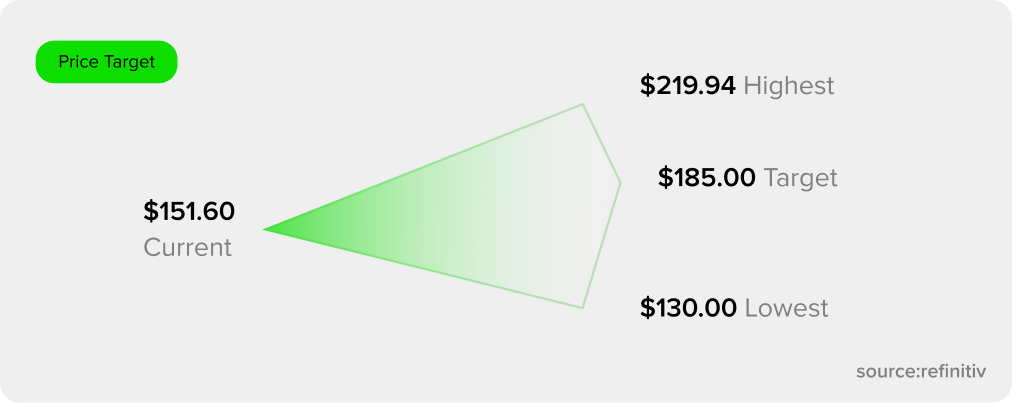

Between Monday afternoon and Tuesday market close, three analysts weighed in on the tech giant: KeyBanc's Brandson Nispel, Citi’s Jim Suva and Goldman Sachs all reduced their price targets.

Citi analyst Jim Suva recently cut his price target on Apple from $200 to $175 due to factors such as foreign exchange headwinds and concerns that Apple's Russian situation will hurt the company's growth10.

KeyBanc's Brandon Nispel cut his price target on Apple from $191 to $173. But remains bullish on Apple as he believes that holding onto the stock is the best approach for investors because Apple has a strong position in several key markets10.

Goldman Sachs and Monness, Crespi, Hardt & Co. also cut their price targets on Apple by double digits, citing concerns about upcoming earnings and the possibility of additional hazards in coming quarters.

Investors should be aware that while analysts' consensus forecast gives us a specific revenue number to consider in our context, the fact that their projections are so far apart demonstrates how difficult it is to predict Apple's sales for the quarter.

Apple's earnings report will be released after market close on Thursday, July 28. Mark your calendar and stay tuned!

1 https://www.msn.com/en-us/news/technology/apple-stock-remains-a-buy-as-the-iphone-turns-15/ar-AAZgUG6

2 https://www.investopedia.com/biggest-companies-in-the-world-by-market-cap-5212784

3 https://www.gizchina.com/2022/06/30/demand-for-smartphones-in-the-global-market-continues-to-decline/

4 https://www.counterpointresearch.com/us-smartphone-sales-decline-6-yoy-q1-2022-pandemic-demand-cools/

5 https://www.entrepreneur.com/article/431356

6 https://www.cnbc.com/2022/07/13/inflation-rose-9point1percent-in-june-even-more-than-expected-as-price-pressures-intensify.html?&doc=107088053

7 https://www.cnbc.com/2022/07/01/wealthy-customers-will-help-apple-resist-the-effects-of-inflation.html

8 https://seekingalpha.com/news/3856453-apple-iphone-sales-have-remained-strong-even-as-smartphone-market-cools-report

9 https://www.forbes.com/sites/bethkindig/2022/07/06/apple-is-techs-best-value-stock/?sh=72e1e5513be0

10 https://www.thestreet.com/apple/stock/apple-stock-should-investors-worry-about-price-target-cuts

Baraka is regulated by the DFSA

Your investment can fluctuate, so you may get back less than you invested. Consider each product’s risk(s) before investing. Baraka is not a financial adviser and therefore does not provide financial advice. Our content is informational only.