Finding someone who hasn’t heard of Amazon is hard to do. Since its inception on July 5, 1994, Amazon has grown to be one of the largest companies in the world. The company started by selling books, but its primary purpose was to harness the power of technology to transform the way consumers shop by making online shopping easy. And it’s succeeded: The share price for Amazon is now over $3,000.00 USD. So, what does all that mean? Let’s look at some basics so you can decide if buying Amazon stock is right for you.

Key takeaways

- There are several factors to consider when buying stock.

- Amazon stock price is high but may have future growth potential.

What is stock anyway?

There are three primary relationships that people can have with a business: They can be buyers of their products or services, they can be employees, or they can be owners. And they can be one, two, or all three of these things. We all know how people become customers or employees, but how can someone become an owner?

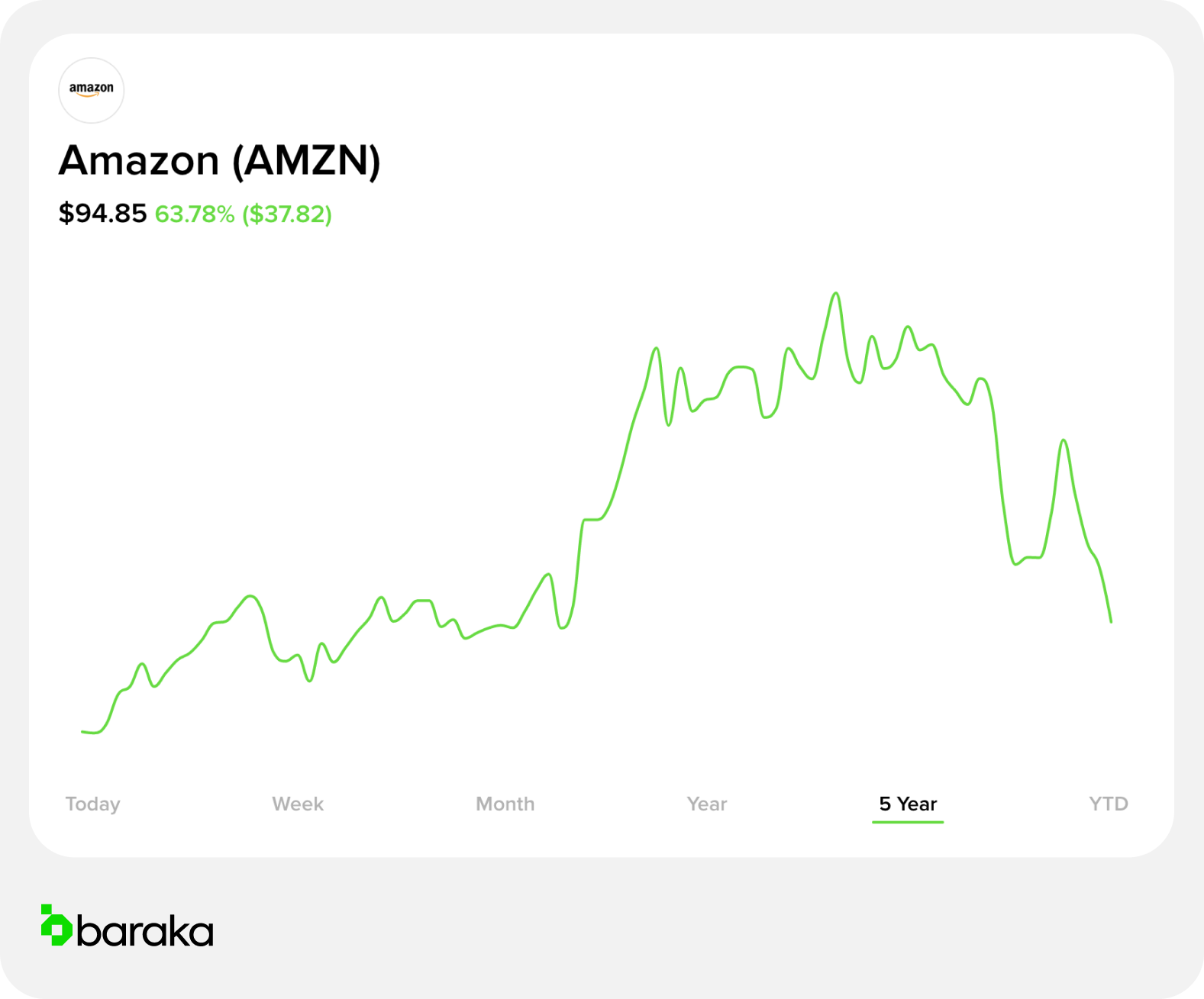

Shares, stocks, and equities mean the same thing and are used interchangeably. When you buy a stock, you're buying a piece of the company and becoming an owner. Owning stock can give you access to profits in the form of increased share prices and other income streams depending on the type of share. As an example, the first shares of Amazon sold for $18.00 on May 15, 1997. Amazon's share price at the time of writing is $3293.97. That’s a significant increase!

Why is Amazon so expensive?

Believe it or not, it's not necessarily the share price that makes a stock expensive. There’s no question that when you look at Amazon stock price, it’s high. But does a high price mean bad value? To figure this out, we need to look at a few things.

Market capitalization

First, we look at what’s called market capitalization or market cap. This measure is used to determine how big a company is. The calculation is done by taking the number of outstanding shares and multiplying it by the company’s share price. If you get a value of over $200 billion, you have a mega-cap, meaning one of the largest available.

Amazon’s market cap is $1.668 trillion, calculated as follows: $3293.97 (share price) x 506.44 million (number of outstanding shares). This company is huge. Sometimes investors shy away from large-cap or mega-cap companies. These investors think the company can maintain its market share but has already reached its growth peak. They believe growth opportunities for these companies are limited. That may be true in some cases, but Amazon might be a very different story (more on that in a bit).

Amazon's Price/earnings ratio

Another thing to look at is the price/earnings ratio (p/e). This ratio is calculated by taking the company’s stock price and dividing it by the earnings per share. This ratio tells you how the market values the company based on its previous year’s earnings. The p/e ratio is the amount people are willing to pay for $1 of the company’s future earnings. If the p/e ratio is above 18, that’s considered high. If the p/e ratio is 15 or less, it's thought to be a low ratio. This rule does not apply in all instances. Right now, Amazon has a p/e of 57.37—well above what’s traditionally considered high. Some investors think that Amazon's p/e ratio is way too high. These investors believe that since the economy is starting to recover, Amazon’s days of high growth are over. Consumers will return to more traditional ways to shop and will not need Amazon as much. Other investors believe that Amazon’s p/e ratio is very reasonable. Amazon has been pursuing new areas of business which, these investors believe, will contribute significantly to the company’s revenue.

Beta

A third metric is beta. Beta is a measure of market volatility, the normal market volatility being 1. If you have a stock with a beta of .78, the stock is less volatile than the market as a whole. If beta is over 1 for the share you want to buy, the stock is more prone to price changes than the market. Amazon stock has a beta of 1.14, indicating that it’s somewhat more volatile than the stock market.

Given that the Amazon share price is high, the Amazon market cap makes it a mega-cap company, it has a high p/e ratio, and the beta indicates it's more volatile than the market, is it worth buying?

What is the upside case for Amazon stock?

We already saw that large-cap or mega-cap companies are sometimes thought to have already reached their maximum growth potential. They have expanded their reach to the point where they don't have much further to go. In cases like these, investors usually believe they’ll maintain their business but do not have much future growth potential. Interestingly, Amazon has seen significant growth in the last two years. There are several reasons for this.

The COVID factor

The first reason is COVID-19. With so many consumers under lockdown or unwilling to go out, many have turned to online shopping. Online ordering and purchase delivery have resulted in a substantial increase in Amazon’s business. A lot of people who never would have shopped online suddenly felt they had no choice. In fact, internationally, Amazon’s business increased 57% year-over-year in the fourth quarter of 2020. That’s huge!

Subscription services

Secondly, Amazon makes a lot of money from their subscription services such as Prime. Subscription services provide ongoing revenue for the company. Amazon Prime encourages shoppers to buy from Amazon since they typically get free shipping. Plus, people use their media services like music and video.

Expanded business offerings

Amazon has expanded its business offerings too. Amazon Web Services (AWS) has grown significantly as more businesses move their computing to cloud services. AWS increased its year-over-year sales in the fourth quarter by an incredible 28%.

Having multiple business lines can mean having many revenue streams. The company bought Whole Foods and expanded into the grocery market. This means Amazon can expand its reach even further into new markets.

Amazon has the potential to keep growing by increasing sales of its products, subscriptions, Amazon Web Services, and by its pursuit of new markets like groceries. These growth opportunities could mean Amazon's stock price could potentially increase even more.

Is buying Amazon stock a good idea?

There are some things to consider before you buy any stock including Amazon shares. Buying stock is not for the faint hearted. All companies can rise and fall in value which will affect your investment.

What are your financial goals?

It’s always wise to ask yourself what you want to accomplish before you invest. Do you want your stocks to fund your retirement or some other long-term goal? Do you need the money within a year or two? Your goals will have a significant impact on whether or not you should buy stock.

If your goals are short-term and you think you might need the money in less than three years, you may want investments with little or no risk. This usually rules out most stocks. The reason for this is because if the market declines, the value of your stocks usually will too. You may not have enough time for your stock prices to recover before you need them, and you could take a substantial loss.

Do you have an emergency fund?

It’s a good idea to have some money readily available to you that has little or no exposure to market downturns and volatility. This will give you peace of mind. You'll know that if you have an emergency, you have money that you can access. It also allows you to leave the money you have in the market invested. When people invest all their money in the stock market and it declines, they tend to pull their money out and can suffer a loss because they could get back less than they invested. If you have money set aside for emergencies, you will be less tempted to do that. Leaving your money in for the long term can allow your investments to recover.

A long time horizon is recommended when investing in stocks. Ideally, 10 or more years is a great time horizon because your money can have time to recover from any downturns in the market and take advantage of market growth.

Do you have a diversified portfolio?

Having a diversified portfolio, gives you room to invest in differing types of assets rather than investing in one stock. If all your money is in one stock and it declines in value or the company goes out of business, your investment will be reduced or might be lost. Having stocks in many companies that cover multiple industries like consumer staples, energy, health care, financial services, and retail can help reduce your risk. Sometimes a few sectors will decline while others will increase so you can achieve a balance by diversifying.

Finally, how much volatility can you tolerate? If your stock declines 10%, 20%, or 30%, will you be comfortable with that? The stock market can have some significant highs and lows. As an investor, you need to make sure that you’re prepared to handle the volatility. Over the long term, buying stocks as part of a diversified portfolio of investments could help you increase your wealth. We have seen that the Amazon stock price went from $18.00 a share in 1997 to $3293.97 today but also, we know that past performance is not an indication of future results While this is an incredible amount of growth, and many investors have benefited from this, it appears that Amazon still could have a lot of growth potential with its retail business, subscriptions, AWS, and entry into other markets but buying a stock like Amazon doesnt come without risk.

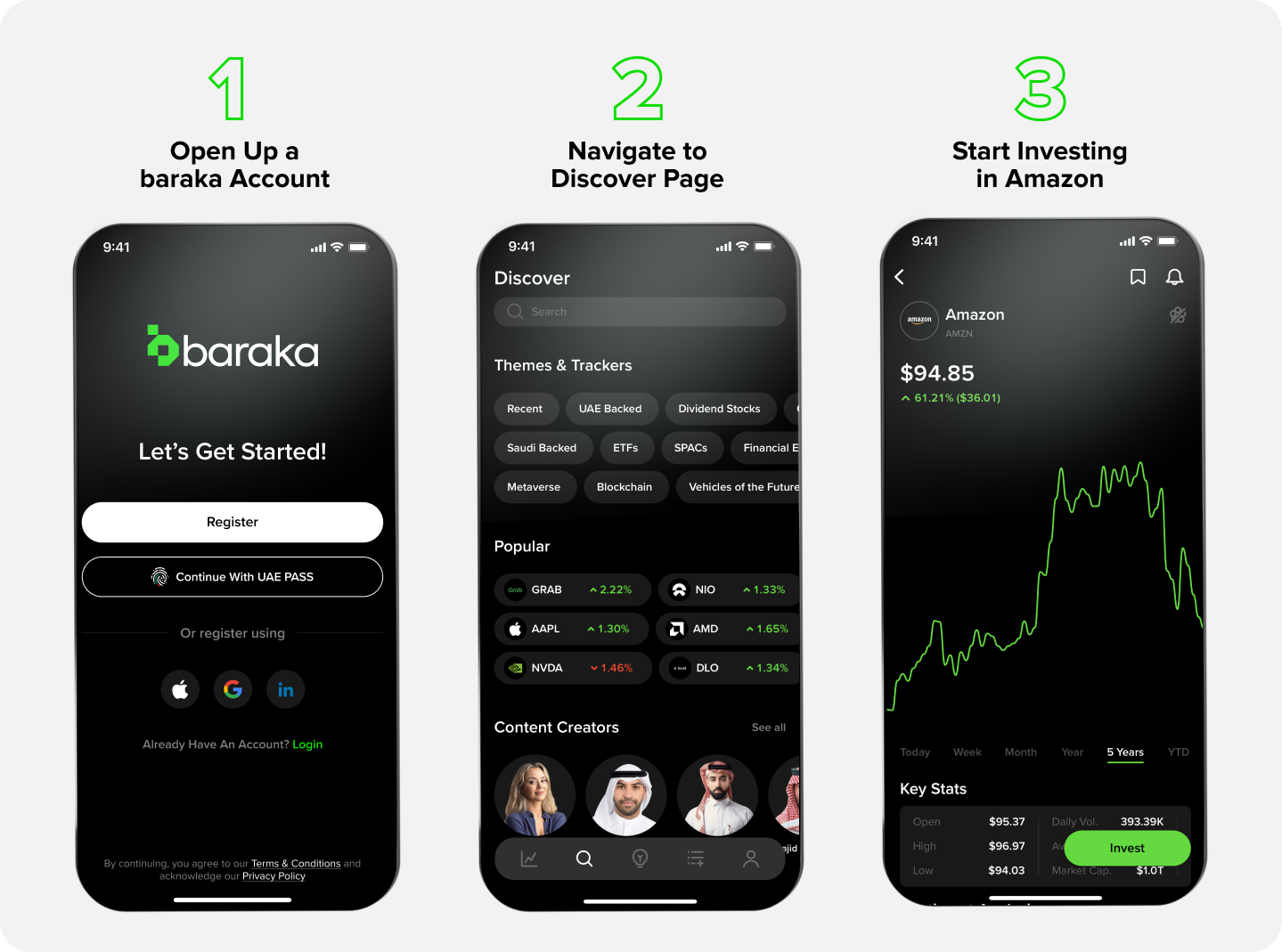

If you want to know how to invest in Amazon stock or stocks of other companies, get the Baraka app today. You’ll get access to over 6,000 US stocks and exchange-traded funds (ETFs) and as an added premium feature, you will have world-class equity research available providing you with stock analysis —including Amazon.

baraka is regulated by the DFSA